Gamification to stock fantasy - A new and eccentric idea for financial services to engage and educate customers

Gamification has shown to be an effective way to engage audiences in a variety of settings, including healthcare and education. Gamification was always viewed with suspicion in more conservative businesses such as finance. But now an array of options like stock fantasy or related games have made investing easy and have paved a way for user engagement in banking and financial planning.

Helping Financial Service Firms Grow and Better Interact with Customers via Online Gaming or Gamification

Financial Services Firms have found themselves amidst an interesting dilemma. The industry has so far managed to thrive economically due to high switching costs, regulatory hurdles that constrained customers, and customer inertia. This reality however is rapidly changing as technology evolves, customers become more demanding and regulators encourage competition. As such, financial institutions have no other option but to change their priorities… abandoning self-serving strategies in favor of a more customer-driven approach.

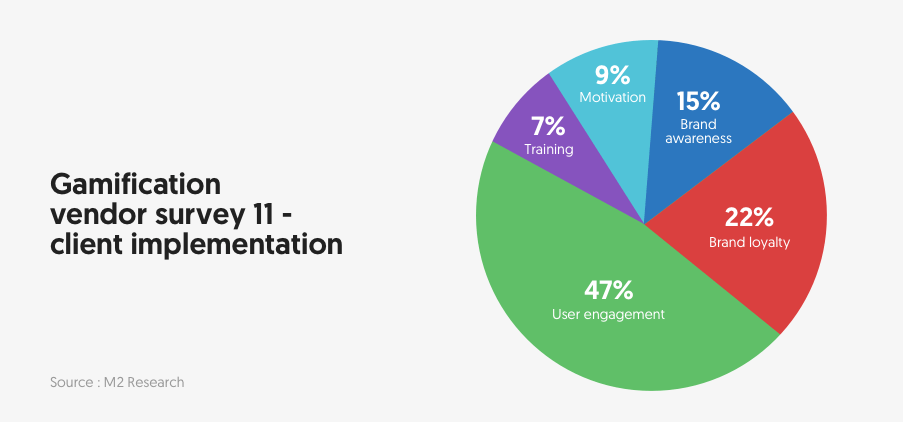

Most financial firms have found that alternative in the guise of Gamification. Contrary to the commercialized view of services adopted by traditional financial firms, Gamification lays more emphasis on customer-centricity. It takes an approach that aims to help customers accomplish their financial goals while keeping them emotionally engaged with the firm and its product.

The Rise of Gamification and its Impact on the Global Financial Sector.

Gamification involves using game tactics to make otherwise dull functions pertaining to finance more engaging, interactive, and appealing. The rise of tech-savvy Gen-Z and millennial generation along with the emergence of smart devices has resulted in gamification becoming extremely popular across multiple business domains, let alone the financial sector.

The global gamification market today is worth 10.3 billion USD. If expert estimates are to be believed, then this number is expected to reach a whopping 38.42 billion USD by 2026. More financial firms are now willingly using gamification to serve a wide range of purposes. They are being used for product development, marketing, education, and most importantly, to boost customer engagement.

There are multiple examples of popular banking and investment firms completely transforming their business models by employing gamification tactics (a few examples of which we will learn later in the article).

Popular Tools that can boost engagement and user growth in a Fun way

1 - Fantasy Games

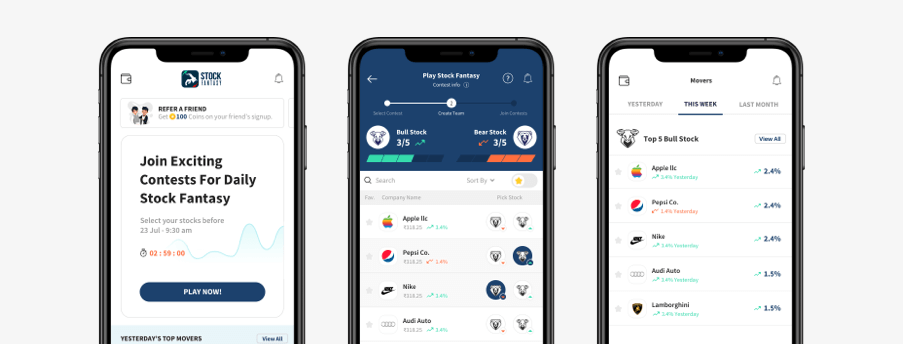

Fantasy games are virtual games played on an online platform, where players compete on imaginary stakes that emulate stakes involved in real-life contests, events, and cases. For instance, fantasy sports is a kind of game where players assemble a team of imaginary players that act as proxies to their real-life equivalent. There is also Fantasy Stock gaming, that mitigates the risks associated with real-life stock trading, thus helping budding investors learn how to be smart investors while earning real money and cash prizes on small investments.

2 - Prediction Games

Predictions Games are a type of trivia game where a player is rewarded for guessing future outcomes accurately. Unlike general quizzes, it doesn’t consider the knowledge of past events. This can be used as a great learning tool to teach investors to anticipate changes in the stock market, handling market volatility as well as preparing them to make better investment decisions.

3 - Quizzes

Quizzes have always been a fun, competitive, and exciting way to learn new things. Using quizzes can be an incredibly effective way for financial service firms to educate their employees and customers on basic and advanced financial concepts. Moreover, you can encourage both these parties to participate in quizzes by granting rewards in the form of badges or cash prizes. You can also inculcate a sense of gratification in them by allowing them to flaunt their achievements on social media platforms.

Principles of Gamification

The crux of Gamification hinges on three core principles

1 - Engage Audience

Perhaps the most significant reason to employ gamification is its ability to boost customer engagement. Financial service firms can use gamification to better interact with their customers. Employing gaming mechanisms like quizzes with rewards attached to them can inculcate a sense of eagerness in the customer to learn more about the product and services that are being offered to them.

2 - Inject Life into an Otherwise boring activity.

Gamification adds a sense of competition to typical proceedings, which eventually results in the otherwise bland process of learning becoming more fun and exciting. Financial services firms can adopt gamification tools like quizzes and prediction games to make learning about important finance and investing terms more fun. As players are also rewarded for their efforts here, they are more inclined to not only take interest in the product or service being offered to them but also spread the word around in their family and friend circles, thus bringing more prospects at a firm’s threshold.

3 - Change Behavior

By making bland activities more enjoyable, by inciting excitement with competition, by triggering a feeling of gratification with rewards, gamification can change human behavior. It can be a great strategy for financial service firms to change the perception people harbor towards them. For instance, Millenials who are otherwise distrustful of legacy financial institutions can be motivated to invest and take interest in financial concepts by employing a good gamification strategy.

4 - Learning Complex Concepts

The world of finance is littered with complex jargon that can be hard to comprehend by most common folks. If there is any department where gamification shines phenomenally, then it is in the learning department. Gamification replaces dull PPT sessions and classroom lectures with adrenaline-pumping training programs pushed through fantasy games, predictions games, and quizzes. This naturally makes the learning process fun. It is easier now to learn complex concepts and remember them until your last breath. Gamification is an especially great tool to improve financial literacy.

The Three Factors Determining the Rising Interest of Gamification in the Financial Sector today

The term gamification was first popularized by a British guy named Nick Pelling in 2002. According to him, gamification referred to the use of game mechanics that helped businesses engage with people digitally and motivate them to achieve their goals. We’ve already mentioned how gamification is customer-centric. The core goal of this concept ultimately boils down to appealing to natural human impulses.

It is about inciting the emotions of fun, excitement, engagement, gratification, and social interaction in potential prospects to satiate the interests of both businesses and consumers. As such, three crucial factors have led to Gamification becoming as popular as it is today.

1 – The Millennial Generation

The millennials were the first generation of people who grew up surrounded by technology. This is a generation that has seen technology evolve and grow with them. As a result, they are extremely proficient at using them than the older generations before them. They are also a section that is more demanding of the convenience technology provides. They are more informed and hesitant in engaging with financial activities such as investing and banking. These groups of people are the future and present of this world. They will eventually replace the baby boomers. Therefore financial firms need to court this generation if they seek to succeed in the industry.

Of course, the best way to engage and interact with this generation is through gamification. It is a known fact that almost half of the gaming community around the world falls in the age group of 25-35 with a median salary of $75000 a year. Millennials demand greater engagement and they can be encouraged to invest or bank with the help of some intuitive gamification tactics.

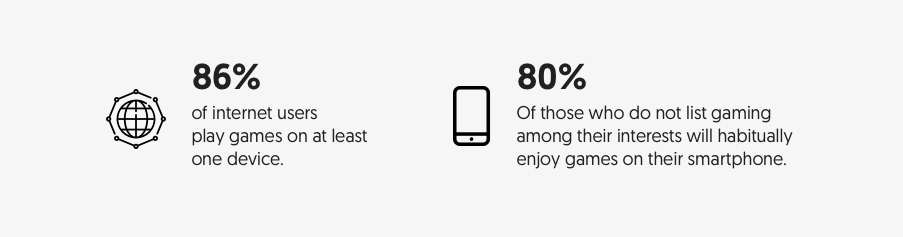

2 - The Popularity of Gaming

Do not underestimate the worldwide gaming market. It is after all a global behemoth worth $300 billion as of 2021. The gaming community has grown by half a billion players in just the past three years. Today, there are roughly 2.7 billion active gamers worldwide. Gaming is no longer just a fun pass-time activity anymore. It has become an obsession… something that can be harnessed by financial firms to provide an immersive experience to consumers and incite interest in their product.

3 – A connected world

Thanks to the internet and an emerging number of smart devices, the world has never appeared as small as it has in recent times. On average, a common American citizen is said to spend at least two hours a day on either the internet or their smartphone. There are, in fact, 5 billion mobile phone subscribers around the world. Almost 95% of the world is said to be connected to the internet in some form or another. This pervasiveness of smartphones and the internet has allowed firms to engage with their consumers in ways that would have been, frankly, unimaginable just a decade ago. People are using the internet for entertainment, socializing, financial transactions, and more.

Factors that Have Affected the Popularity of Fantasy Stock in the Finance Sector

1 - Learning Investor Basics

It is an undeniable fact that most people are hesitant to consume financial literature because it can be dull, tedious, and hard to comprehend. However, that doesn’t mean they don’t want to learn these concepts and profit from this knowledge. This is why more and more people are turning to gamification to learn and understand basic concepts about investing and finance.

Fantasy Stock applications transform the learning experience about finance with competition and rewards, thus making it more fun and exciting. It is an especially magnificent tool to boost one’s financial literacy with regards to basic investing concepts such as bonds, stocks, mutual funds, real estate, and more.

2 - Diversifying Portfolio to Reduce Risks

Diversifying your portfolio is one of the most recommended financial planning strategies when it comes to reducing risks associated with one particular asset. It is a strategy implemented to spread out your investments in a bid to minimize risks you may suffer from investing in a potentially bad asset. To put it succinctly, don’t put all your eggs in the same basket. Fantasy stock market apps can act as important learning instruments that teach how to diversify your portfolio and cut risks short.

3 - Avoid Concentration Risk

Concentration risk is the probability that you will lose money depending on a single investment portfolio. Naturally, every investor must try to avoid concentration risk. Fantasy stock market apps teach you how to diversify your portfolio, easily selling investments, and rebalancing consistently. Remember, you are learning how to handle such risks without actually facing the real-life consequences attached to them.

4 - Macro factors Investors Need to Learn

Usually, two macroeconomic factors significantly affect the stock market. The GDP (gross domestic product) and Inflation. A fantasy stock market app can provide important insight into these concepts, teach you how to analyze them, and anticipate the return they can expect based on the current circumstances related to these two terms.

5 - Dealing with Market Volatility

An investor must be capable of handling market volatility to expect better returns from his/her market. A fantasy stock market app can help aspiring entrepreneurs manage risks, diversify their portfolios, remain invested, and seek profitable opportunities to better navigate through market volatility.

6 - Build Confidence

The ultimate goal of any fantasy stock market gaming app is to increase the financial knowledge of its players concerning investment and fundamental financial concepts. It is a tool that can be used to teach budding investors to make smart investment decisions in a simulated environment. The real-world risk of taking huge losses is completely absent here so aspiring investors can practice trading with investments as low as $5 and earn real money in the process. The system is designed to build confidence among investors and prepare them for real stock market trading with high risks.

Typical Applications of Gamification in the Financial Services Sector

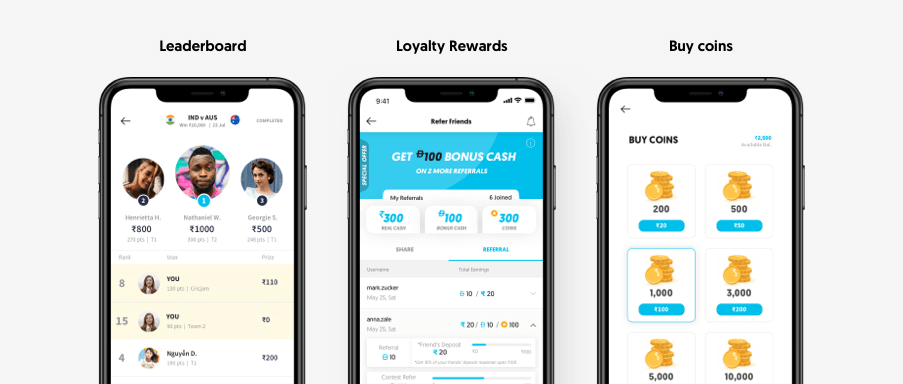

1 – Educating Investors through Fantasy Stock

A fantasy stock market trading game can be employed by several financial institutions to make financial literacy in investment and stock markets more fun and engaging. Such gaming tools blend the simulated action of Wall Street with intense gaming mechanisms to help players win real cash prizes by participating in a low-risk stock trading environment.

Fantasy Stock gaming apps can be insightful and educational for aspiring investors. Gamification can make learning important financial skills more fun and engaging. You can learn how to invest in stocks with a smaller sum, thus amateur investors can learn how to be confident when buying and selling stock. You can learn how to make smarter and lucrative investment decisions. You can also learn how to trade in cryptocurrency while boosting your knowledge of fundamental investing/finance

Such games significantly modify the real-life experience associated with stock trading. Popular android and iOS apps like Trade-Off and Invstr deliver a strategy game that specifically targets individuals who do not wish to partake in stock market trading because of their inherent skepticism towards most financial institutions. By simplifying the concept of trading and eliminating risks of monetary loss in real-life trading, such apps have been instrumental in encouraging the otherwise cynical generation of millennials to start investing as well.

2 – Encouraging a Saving Culture among Bank Customers

Banking institutions can encourage their customers to save more by employing gaming mechanisms that set saving goals. A prominent example of gamification here can be the capping of bank transactions and investing the rounding difference. This includes long-term and midterm investing, short-term saving, and pension planning.

3 – Employee Development

Bank and insurance employees can be better trained with real-life simulators as opposed to boring PPT lectures and books. Gamification keeps employees more focused on the training programs and they are also able to remember much more of what they have learned, which is often not the case with traditional training programs.

4 – Helping Customers better manage their finances.

Banking institutions can arm their customers with intuitive personal financial management apps. Such apps allow them to keep track of their spending and earnings. As such, they can prepare a budget plan that helps them manage their finances effectively and efficiently.

5 – Increasing Financial Literacy

There isn’t a better way to help teach your customers and employees about basic and advanced financial concepts than using gaming tactics. Short movies, informative games, and case-based simulators can help financial institutions familiarize their customers on simple terms like inflation and diversification as well as complex terms like risk management and investing strategies.

6 – Helping Insurance Firms help reduce risk of claims on Insured Good

Gamification tactics like usage-based car insurance can help insurance companies reduce the risk of claims by keeping track of how the car was used. Such tactics also help insurance companies maintain a scoring dashboard that indicates fundamental points on a particular customer’s driving behavior.

7 –Creating a Positive Company Image

Gamification tactics may not directly result in accelerated profits for banking or insurance companies, but they can help them earn a lot of goodwill in the industry. By employing gamification tactics that encourage customers to be more environmentally conscious, pushing for local and healthy consumption, donating to charity, reducing wastage of paper, cash via digital payments, and encouraging more digital transactions, a financial institution can establish itself as a major ethical player in the eyes of customers.

Real-World Cases of Gamification working for Financial Institutions

1 – Aviva Italy – Insurance

The insurance company Aviva Italy introduced a mobile app that evaluates a customer’s driving skills. It provides them valuable information about a customer’s driving scales by rating it on a scale of 1-10 over 300 Kilometers. The trip ends and provides feedback on fuel efficiency, acceleration, braking, and cornering. Customers can earn rewards in the form of badges for proper driving and share them on social media channels like Facebook. The app can also be used to obtain a quote for insurance.

2 – Commonwealth Bank of Australia – Banking

The Commonwealth Bank of Australia developed an app called Investorville that aims to increase their customer’s literacy on real estate buying and owning. It simulates the whole procedure of buying and owning a property. At the end of their simulation, players have some insight on paying property taxes, and the impact different types of mortgages and loans will have on them.

3 – Sun Life – Investment

Sun Life Financial, a Canada-based investment firm introduced an online gamification platform called Money Up. It aims to educate consumers on retirement and investment. The game is designed to cater to younger players with quick feedback and technical learning. The players are required to cross levels by answering quizzes that furnish their financial knowledge.

The Bottom Line

As you know by now, gamification can be implemented effectively by financial services firms to improve customer engagement, enhance their services and reduce distribution costs. With a rising number of millennials and smart devices, gamification is going to become an integral part of a financial service company’s growth and development strategy in the coming years. The benefits of Gamification go beyond simply improving customer engagement.

Gamification is a great way for financial service firms to educate their customers about imperative concepts about investing and finance, albeit in a fun and exciting manner. Complex finance terms are easier to grasp because there are rewards motivating people to learn, engage and invest. Moreover, gamification eliminates the monetary risks associated with real-life stock market trading, thus budding investors can sharpen their financial skills without hesitation or fear of huge losses.

Gamification can help financial service companies in the following ways:

- Reduce the cost of customer acquisition

- Reduce the cost of service delivery

- Keep customers and employees better informed about crucial financial knowledge.

- Improve financial literacy with regards to investment

- Help insurance companies reduce the risk of claims

- Help banking institutions inculcate a savings culture among their customers

- Encourage customers to invest with the help of Fantasy stock apps.

The benefits of gamification are endless for financial service firms, provided they are implemented efficiently. If you are a financial firm that wants to employ gamification tactics to improve its growth plans and enhance customer engagement, then look no further than Vinfotech.

We at Vinfotech can be the ideal software/app development partners you need to help your financial service firm create a robust gaming app to increase engagement with your customers and employees alike. You can get in touch with us now to learn more about how we can help your Banking, Insurance, or Investment planning company thrive in this competitive industry with gamification.

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.