An investor's guide to the Indian gaming industry

India gaming industry is on the verge of becoming one of the leading markets in the Gaming Sector.

The online gaming industry in India is on the verge of quadrupling its revenue. With one of the world’s largest youth population and the second-largest in internet penetration, India is going to become one of the leading markets in the Gaming Sector, globally. The buoyant growth has attracted attention from some of Asia’s biggest internet companies and major brands have been eyeing to break into India’s thriving market for quite a long time.

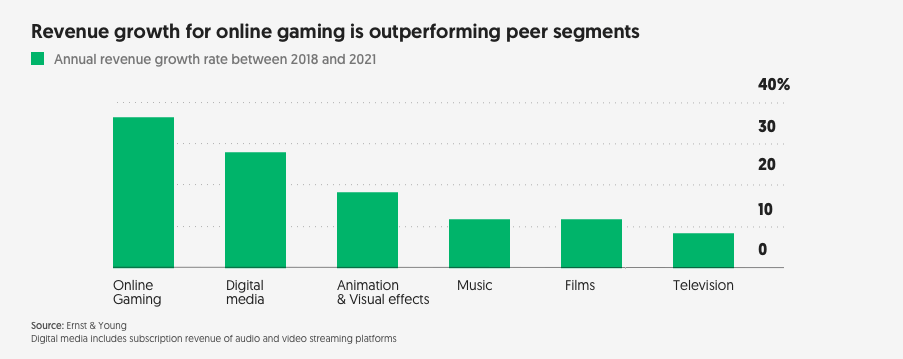

In 2018, global gaming revenue was $134 billion, more than the combined worldwide revenue from the movie box office ($41 billion), video streaming ($36.6 billion), and music ($19 billion). According to Reuters, while other forms of entertainment are experiencing a decline – T.V. revenue fell by 8% last year – the gaming sector is here to stay, with sales increasing at an annual rate of 10.7%.

India has never failed to register a phenomenal response from gaming enthusiasts of the country. It is transforming into one of the fastest-growing economic sectors, bringing in billions of dollars in revenue to the entertainment industry. With around 300 million gamers generating about 43% of the annual gaming revenue growth forayed into the market, marking a tremendous potential in this sector. In view of the report published by Nasscom, India's mobile gaming market is expected to reach 628 million users and be worth $1.1 billion by 2020.

But with new opportunities come new challenges. India is a large and incredibly diverse country and a home to different kinds of interests and obsessions. Cracking the code to the Indian gaming market will require thorough planning & expertise.

Rise of Online Gaming in India

In the early 90s, India was exposed for the first time to gaming. Hand-held gaming consoles, popular back then, failed to pick up the pace because of extremely low P.C. penetration and expensiveness of console gaming- PlayStations and Xbox.

With increasing access to affordable broadband mobile and greater choice in smartphones, the mobile gaming industry has seen a growth in the last few years. In India, revenue in the Mobile Games segment is expected to show an annual growth rate (CAGR 2018-2022) of 9.8% resulting in a market volume of USD 943 million in 2022. User penetration in the Mobile Gaming is at 19.9% in 2018 and is expected to hit 26.0% in 2022. 95% are mobile-centric games.

In addition to that, India has the cheapest data globally, with an average cost of 1GB at $0.26 in March 2019, compared to $12.37 in the U.S. Moreover, in India Android has over 2 billion active devices, and over 250 million apps are downloaded every day from the Play Store. There remains a huge opportunity for developers across the globe to develop successful and scalable businesses across the platform.

The gaming sector in India has hugely benefited from the adoption of games apps on smart devices and the transition from physical distribution to digital distribution. The growth of the sector has been fuelled by the availability of free content and in-game monetization, which has elevated the adoption of games.

Understanding the Indian gamer

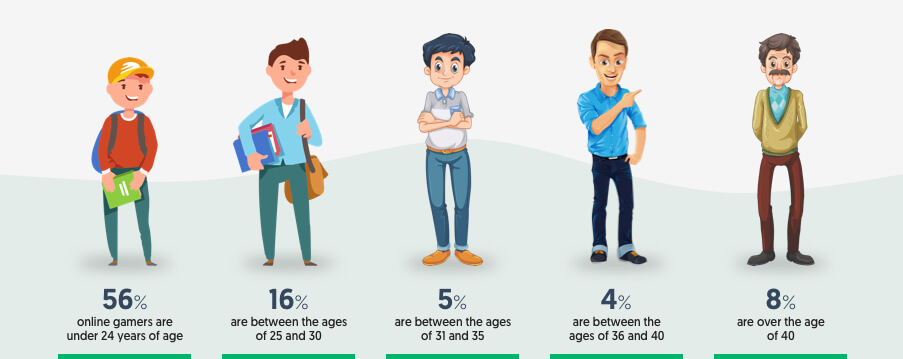

The future of gaming, in emerging markets like India, is now mobile. The average gamer in India spends 42 minutes a day on mobile games. Based on a 2017 KPMG study, nearly 60% of mobile gamers are below the age of 24. The young age group is more exposed to technology & online platforms, so it makes sense that they comprise a large portion of the market. Here’s the look at numbers break down according to a report shared by KPMG-

When it comes to gender classification, there is a higher number of males playing games than are females. 83% of the gaming audience is males. In any case, that imbalance isn't too astonishing when 80% of the internet users in India are male. In this manner, relatively, there is a comparable penchant of web-based gaming in both genders. A heavy gamer spends a normal 55 minutes of playing games every day. An enormous 54% of overwhelming gamers in India play online puzzle games. The following most loved genre is action games & 49% of gamers play these adrenaline-surge games. Here is a glance at the other most mainstream genres preferred by the heavy gamer-

- Arcade: 37%

- Racing: 34%

- Sports: 31%

- Strategy: 30%

- Skill-based: 17%

- Chance-based: 12%

A huge percentage of young gamers of the age bracket of 18-24, play action games, and have an inclination towards sports events. Based on various estimates, PUBG Mobile is the top preferred choice, generating about 7 million dollars per month in India. Meanwhile, over half of gamers between the ages of 35 and 54 like playing puzzle games the most.

Adaption to Mobile

Mobile gaming is the future of emerging markets like India. Porting to mobile alone is certainly not a powerful solution for its success. India is a large & diverse country. It’s multicultural and socially diverse demographic requires profound understanding before venturing into the business.

The gaming content and themes to be developed keeping in mind local preferences and languages. The Indian language internet users are expected to rise to ~540 million in 2021. Nowadays, users are on a lookout for an immersive gaming experience, which heavily relies on both localization and translation. Users must be able to resonate with the characters and the game story. When it comes to translation, the platforms developed for the Indian audience cannot simply rely on English or Hindi language. Gaming platforms must be multilingual with the ability to handle multiple languages to help brands communicate well with the local audience.

For culturizing a mobile game for the Indian market, employing local talent from that region you want to launch your product in, is the best way to ensure that your game will be culturally relevant.

Freemium model is expected to improve monetization

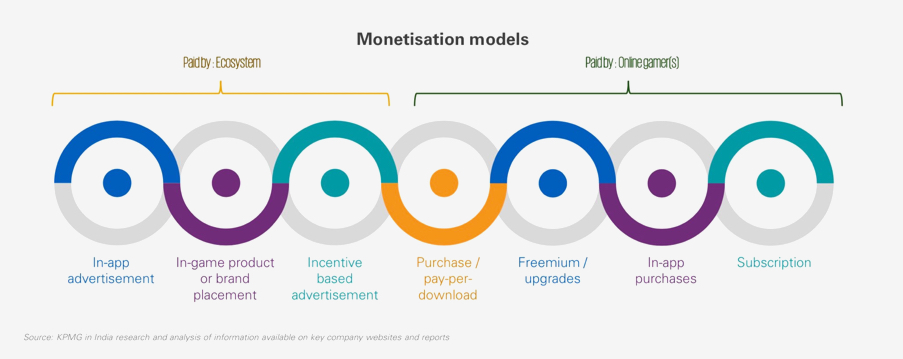

The Indian gaming audience was generally not known to have a lot of players with spending capability. In mobile gaming, 90 percent of players paid nothing at all and the other 7-8% would pay between $1- $5 during the lifetime of playing. Companies used to survive on the amount collected through in-app purchases.

With a population of over 1.4 billion, it's estimated that 55-60% of internet users are gamers, and the number of gamers in India outnumbers the total population of the United States. Unlike China, where the ARPU is relatively high for mobile gaming, the ARPU in India is relatively low.

The spending patterns in India are changing and getting better. Though it’s unlikely to see everyone paying. But with payment gateways getting more flexible, advertising-supported content, microtransactions, and subscription services, gaming companies have started drawing payments from the audience. In India, economic success comes from scale. Despite the low incremental value, the volume of players is crucial for revenue growth. Companies all over the world are expected to enter the thriving Indian internet gaming market. Though, monetization has been a challenge in the past for the companies. As of now, income models in the business incorporate.

Another popular tactic for companies is freemium strategies. Companies just starting out try to lure users to their services & then charges for "upgrades" to the basic package. Freemium strategies are pretty successful as they offer a gaming experience without committing to an initial purchase price.

Esports will contribute to a significant portion of that revenue

Quarantine culture has seen a surge in online gaming and sports simulation from all over the world. eSports, or electronic sports which was previously in a nascent stage in India, is witnessing a boom during the lockdown period. Fans are left with playing online games and watching other people play them from computer and TV screens at home. Some of the popular eSports played by Indians are- PUBG Mobile, FIFA 20, Counter-Strike, League of Legends, among others.

The potential for growth in Esports is tremendous. The growth for Esports globally, and especially in India, is via mobile. By 2020, it's predicted that 41% of gamers will be primarily gaming on their phone. The trend will be followed in esports as well.

eSports tournaments are growing in popularity in the country and are set to overtake traditional sports entertainment in many cases. 2019's League of Legends Championship nearly surpassed that of the Super Bowl, and esports teams and competitions are drawing in sponsorship from big giants like Nike, Twitch, and Red Bull. Revenue from esports alone is projected to reach nearly $1.8 billion in the next three years, and India is all ready to contribute to a significant portion of that revenue.

Fantasy Sports

India is home to different kinds of interests and obsessions. Despite the diversity, sports always bring a sense of national pride that is incomparable to any other form of entertainment. The concept of fantasy sports revolves around live sports events and cultivates the same value as any other sport. With the introduction of major leagues in Cricket and other sports like Football & Kabaddi, India has witnessed a transformation in the fantasy sports landscape. Today, fantasy sports has refined the way fans engage with their favorite sport. Fantasy sports has enabled passive viewers to become an active user by providing them with real-time gaming experience. Smartphone penetration along with cheap data rates by the telecom providers has triggered the growth of fantasy sports in India.

Currently, India has more than 20 million fantasy sports users. The number is expected to grow up to 100 million by 2020 with a staggering 89 percent of users playing fantasy sports at least once a month, 71% of the respondents playing fantasy cricket with 85% being mobile users. After realizing the immense potential of fantasy sports, eminent venture capitals have started investing in fantasy sports companies. India recently got its first gaming unicorn - Dream11 now valued at $1.1 billion after the latest fundraise from Steadview Capital.

Indian statistics are not only in favor of fantasy sports and with online gaming that involves wagering money. Thus, the numbers are very optimistic about this new trend, and its future looks bright and stable.

Gambling Laws and Regulation in India

Gambling is a state subject in India, yet the standard in many states is this: If a chance-based game is played with stakes, it is gambling. But if a skill-based game is played with stakes, it is not gambling, but real-money gaming (aka skill-based gaming). More skill, less chance is legal. Less skill, more chance is illegal. With few exceptions, including Sikkim, Goa, and Nagaland, this is the standard.

After many court judgments, a two-step test is standardized to determine whether a game is skill-based or chance-based. Test one: A player must be able to choose to lose. He exercises some agency in winning. (Snakes and ladders would fail this test, but Ludo would pass.) Test two: A player’s performance must improve over time. Consistently and steadily. The second is a tough test and one that troubles the gaming industry immeasurably, because, in the real world, performances often plateau, or rise and fall cyclically. Rarely, if ever, does performance have a steady, positive slope.

Playing a game for stakes is legal in most parts of India only. If the game passes both tests then it is real-money gaming, not gambling. That is why a Punjab and Haryana high court ruling has adjudged that the version of fantasy football played on Dream11 (where you choose 11 players from across a league to beat the odds on the market) was akin to a business, requires skill, and was, therefore, legal. A Supreme Court ruling says that horse-racing is a skill-based game because one needs to know a thing or two about horses. Texas hold ’em poker is found to be skill-based in most states.

With a growing consumer base and emergence of new technologies in the market, the Indian game developer ecosystem will have ample opportunity to innovate and provide compelling content with social and cultural context, which is key in engaging the Indian consumer. Through the world of digital gaming accessed via smartphones, the nation can enjoy a plethora of exciting options at the tap of a screen. The gaming trend will only continue to grow as the Indian gaming industry establishes itself as a giant on the global scene.

We at Vinfotech are in constant pursuit of evolving alongside the industry to ensure that our clients get the best product and best of our advice. With our latest product upgrade, we have launched SportsHub- a one-stop solution for all the engagement needs of fans. We are committed to providing high-quality solutions to our clients venturing into the gaming space. Contact us and we will be happy to guide you in the right direction.

- In 2018, global gaming revenue was $134 billion, more than the combined worldwide revenue from the movie box office ($41 billion), video streaming ($36.6 billion), and music ($19 billion)

- India's mobile gaming market is expected to reach 628 million users and be worth $1.1 billion by 2020.

- The future of gaming is the young age group as it is more exposed to technology & online platform.

- Immersive gaming experience heavily relies on both localization and translation.

- Freemium strategies are pretty successful as they offer a gaming experience without committing to an initial purchase price.

- Revenue from esports alone is projected to reach nearly $1.8 billion in the next three years.

- India has more than 20 million fantasy sports users. The number is expected to grow up to 100 million by 2020.

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.