Prediction Markets: The Hottest Trend in iGaming

Discover how prediction markets are transforming iGaming. From ICE’s $2B Polymarket deal to real-time trading, the future of wagering is here.

The iGaming landscape is constantly evolving, but a recent landmark deal has signaled the next great transformation: the ascent of Prediction Markets. Forget traditional fixed-odds betting for a moment; the future of engaging, dynamic, and data-driven wagering is here, and iGaming operators need to take notice or risk being left behind.

The strategic investment by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, into the prediction market platform Polymarket is more than just a massive financial transaction—it’s a powerful validation. With ICE committing up to $2 billion in an investment that values Polymarket at roughly $8 billion, this deal is a bold statement from a traditional financial titan, blending centuries-old market infrastructure with the cutting-edge of decentralized, event-driven trading.

The ICE-Polymarket Deal: A $2 Billion Seal of Approval

The significance of the ICE-Polymarket partnership cannot be overstated. It represents the institutional embrace of prediction markets, which operate by allowing users to buy and sell "shares" in the outcome of real-world events—from political elections and economic indicators to cultural moments and, crucially, sporting results.

For ICE, this investment is about securing a new, highly accurate data source. Prediction market prices are dynamic, updating in real-time as new information emerges, making them a powerful barometer of collective sentiment and probability. By becoming a global distributor of Polymarket's data, ICE legitimizes this information for institutional investors.

For iGaming, the message is clear: The mechanism of prediction markets is becoming mainstream financial infrastructure. The clear, exchange-based trading model, combined with high liquidity and real-time pricing, is a massive leap forward from the static odds offered by traditional sportsbooks.

This isn’t an isolated headline. Kalshi has been setting volume records (topping $1 billion in a single month, with weekends now clearing hundreds of millions, largely in sports), and Robinhood has rolled out a Prediction Markets Hub in partnership with Kalshi—directly inside its app. In short: institutional capital, retail distribution, and deepening liquidity are converging.

Why Prediction Markets Are a Game-Changer for iGaming

Prediction markets introduce a layer of engagement, transparency, and product variety that legacy iGaming operators desperately need to capture the next generation of users. Here’s why this product mix is no longer optional:

1. Superior User Engagement and Flexibility

In a traditional sports bet, once you place your wager, your involvement is passive until the event concludes. Prediction markets, however, operate like a stock exchange:

- Trade In, Trade Out: Users can buy and sell their positions at any time before the market resolves, allowing them to take profits early or cut losses if the probability shifts. This creates constant, high-stakes engagement throughout the event.

- Price Discovery: Instead of betting against the house (the bookmaker), users trade peer-to-peer. The contract price reflects the market's collective, real-time probability of the outcome, offering a level of transparency that resonates with modern, financially-literate consumers.

2. Unlimited Market Opportunities (Beyond Sports)

While sports betting is lucrative, prediction markets break down the content barriers:

- Politics and Culture: Prediction markets have proven incredibly accurate in forecasting elections, award show results, and even company performance. iGaming companies can leverage this model to create engaging new verticals that tap into global current events, attracting a wider, more diverse audience than traditional sports bettors.

- Micro-Events: The format is perfect for granular, rapid-fire wagering. Think: "Will a goal be scored in the next 5 minutes?" or "Will the stock index close above $X today?"—turning any event into a continuous trading opportunity.

3. The Appeal of an "Exchange" vs. "Bookmaker"

The language matters. Prediction markets frame the activity as trading or investing in the probability of an outcome, rather than just "gambling." This shift in framing is highly attractive, especially to:

- Millennials and Gen Z: These demographics are already highly engaged with stock trading apps, crypto exchanges, and real-time financial data. Prediction markets offer a familiar, interactive interface that aligns with their existing digital behaviors.

- The Informed User: Users who believe they have superior information or analytical skills are drawn to the exchange model, where they feel they are competing against other traders, not a fixed house margin (vig).

4. Future-Proofing with Tokenization

ICE's plan to partner with Polymarket on "future tokenization initiatives" hints at the next step: integrating these markets more deeply with blockchain technology. For iGaming companies, embracing this trend early allows for:

- Increased Transparency: Blockchain-based markets offer immutable settlement and transparent contract mechanisms.

- Global Reach: Decentralized models can, in time, facilitate easier access to global markets and liquidity pools, which is a key advantage for platforms like Polymarket.

F2P and P2P: one funnel, two signals

Free-to-Play prediction markets remove payment friction and scale to mass audiences; they’re ideal for broadcasters, leagues, and sportsbooks running fan-engagement layers on tent-pole events. You capture broad sentiment, build first-party data, and sell sponsor integrations—no cashier needed.

Pay-to-Play (where allowed) attracts sharper cohorts with stronger incentives, typically yielding tighter spreads and more stable prices. It’s the natural home for in-play trading and for event contracts that support risk-managed promos. Robinhood’s integration of Kalshi’s markets shows how quickly mainstream trading UX is normalizing this behavior.

Savvy operators run both: F2P for reach and top-of-funnel insights; P2P for precision, depth, and monetization.

What this means for the iGaming roadmap (next 6–12 months)

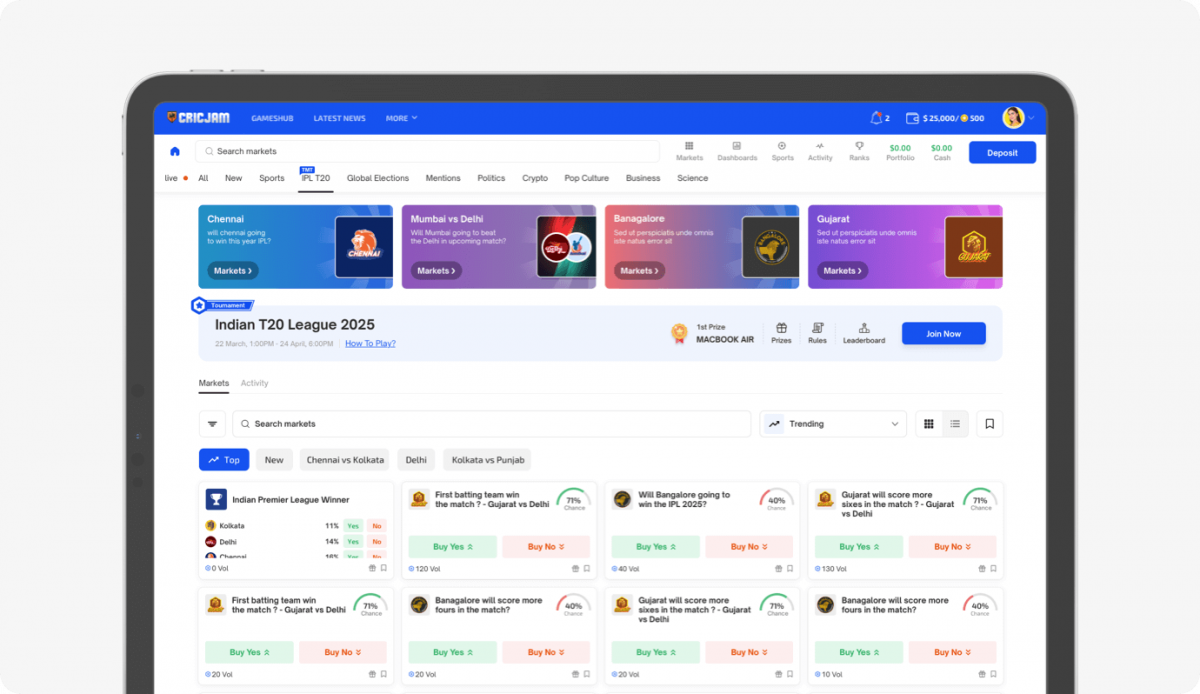

Launch a live prediction tab alongside sportsbook and fantasy. Start with binary markets (win/lose, total over/under) and a handful of combinatorics for marquee fixtures. Tie markets to notifications—“price swings,” “late-game surges,” and “line-up shocks”—to create habitual check-ins.

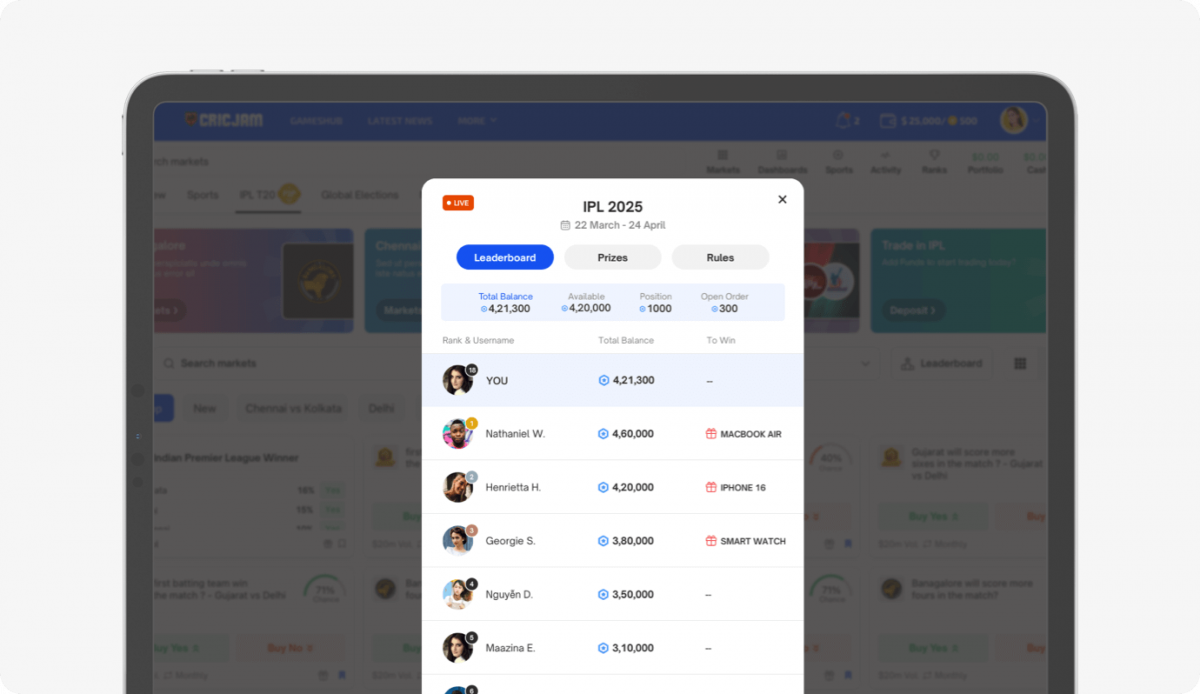

Instrument the data layer from day one. Capture time-stamped prices, liquidity, and user-consented cohorts (age bands, regions, team affinities). Surface them as calibration dashboards for product and as sponsor-ready storylines for sales.

Design for integrity. Publish resolution criteria; use independent oracles; implement position limits, circuit breakers, AML/KYC where required; and keep transparent dispute logs. This is how markets remain fun and fair.

Build the studio package. Bring prices on-screen. Let hosts react to market moves. Package “odds-aware” segments for advertisers. This is new, premium inventory—priced off live attention, not just impressions.

The macro signal you can’t ignore

The category is gaining institutional endorsement and retail distribution at the same time. ICE’s up to $2 billion Polymarket deal with institutional data distribution is a watershed moment; Kalshi’s $1B+ monthly volume and sports-heavy weekends prove depth; Robinhood’s launch puts event trading a tap away for millions. Together they argue for a simple thesis: prediction markets are becoming a core lane of wagering and interactive media, not a sideshow.

How Vinfotech helps you ship it right

Vinfotech builds custom prediction market software for iGaming operators, leagues, and media networks. We deliver

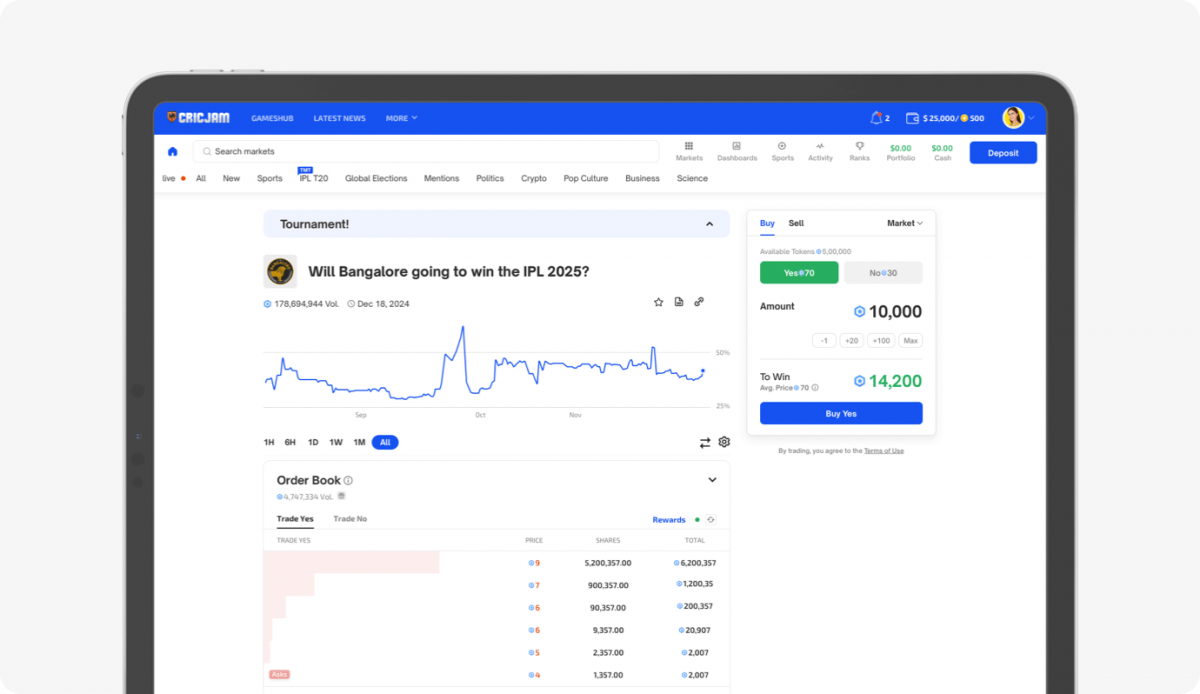

- Production-ready mechanics: order book or AMM liquidity, binary/multi-outcome/range markets, in-play updates, and smart market creation tools.

- Enterprise analytics: probability timelines, liquidity/volatility signals, and cohort-safe insights designed for product, trading, marketing, and sales.

- Compliance & trust: KYC/AML hooks, geo-fencing, responsible gaming, independent oracles, and auditable settlement flows.

- Beautiful, fast UX: trader-friendly interfaces for P2P; accessible, sponsorable surfaces for F2P; embeddable widgets for broadcasts and apps.

Whether you want a fan-scale F2P layer to grow first-party data—or a reg-ready P2P exchange for high-signal monetization—we’ll tailor the platform to your jurisdictions, brand, and roadmap.

Conclusion: Time to Buy In

The $2 billion ICE investment in Polymarket is a siren call to the iGaming industry. Prediction markets are not just a novel betting product; they are a superior technological and financial framework for aggregating collective wisdom and monetizing outcomes. They offer unparalleled user engagement, transparency, and a vast, untapped market of non-sports events.

For any iGaming company looking to secure its future, the strategy is simple: Integrate prediction market technology into your product mix now. The giants of Wall Street are already betting big on this trend. To remain competitive, iGaming must adopt this next evolution of event-based trading and usher in the age of the informed, engaged, and empowered digital bettor. The hottest trend in iGaming isn't a new slot machine or a bigger bonus—it's the power of the crowd, structured as a market.

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.