5 financial institutions reimagining engagement with gamification

Few banks have cracked the code to fan engagement–gamification. Here we look at some of these banks doing it right.

The banking value-chain has disintegrated over the past few years, and today, innovative solutions from FinTechs dot the entire value-chain. What started as a combative reaction to safeguard their turf has evolved into a collaborative relationship between banks and FinTechs. Banks are scouting FinTech partnerships across the back, middle and front office. However, banks continue to face increasing competition from neo-banks that operate at cost-to-income ratios far beyond the reach of banks. These agile digital-native neo banks aren’t saddled with legacy technology and offer all their banking services online. Traditional banks are struggling to engage their customers as these neo banks do. They have embarked on their digital transformation journeys, especially to achieve the end-goal of customer engagement. According to a 2020 global study by the European Financial Management and Marketing Association (Efma), a whopping 87% of the respondents—financial institutions across the world—stated customer engagement was at the centre of their digital transformation plans.

Most FinTech apps rely on game elements to boost customer motivation and engagement. This is the kind of engagement banks want to be able to offer to today’s techno-savvy customers. There are several successful use cases of gamification including encouraging customers to increase savings, boosting financial literacy, managing insurance risk, and more.

Here, we look at 5 financial institutions—traditional banks and digital banks—that are leading the way with gamification.

1) Commonwealth Bank of Australia has launched Investorville, an application for property brokers and investors. The application is a simulation of real-life investment market, a fun and engaging way to get people to dabble in an otherwise complex world of property investment. Users can participate in the property market without the risk of investing their own capital. Users/players pay property taxes, and perform other transactions such as mortgages and loans just as they’d do for real-life property. Data such as properties available and asking prices reflect the realities of the market.

2) Malaysia’s CIMB Bank’s OctoChallenge is a service that uses points, progress charts, and lottery mechanics to assign missions to users. The service is a part of CIMB Clicks’ mobile banking application. The service rewards users for their engagement; the points can be used for offers on e-commerce platforms such as southeast Asia’s superapp Grab.

Another initiative by CIMB targets youth from the age of 12 years to 24 years aims to ‘catch them young’, and help them cultivate a habit of saving before spending. The service rewards users with interest rates. The more the users save, the higher interest they earn. Users that maintain a consistent average quarterly balance earn double interest.

3) US’s first paperless and branchless bank Moven has been at the forefront of the banking revolution replacing personal finance institution (PFI) with personal finance application (PFA). It applies simple behavioural gamification to help users achieve their goals. The app’s ‘Lock Away Savings’ is a feature that nudges users to save in moments of impulse buying. Intuitive UI turns the color-coded spending-meter green during moments of impulse buying. The ‘Visual Wish List’ feature allows users to make a wish list of items they want to save for.

4) Revolut, a digital bank in the U.K. uses lotteries and raffles to incentivise payments and transfers. When customers make payments or transfers using Revolut, the bank’s app rewards them with points which enter customers into weekly draws of cash prizes ranging from £1 to £10,000. The more customers use Revolut, the more points they win, and the higher they rise in the ranking.

5) When Extraco bank in the U.S. wanted to discontinue its free-checking account offering, the bank launched an interactive online game. Customers were asked questions about their banking habits such as the amount they typically kept in their accounts and how often they used their debit cards. The app in turn shared tips about how much depositors could save by paying bills online and direct deposits. Extraco used gamification to help make the customer make the transition.

Conclusion:

Most traditional banks are grappling with a multitude of challenges including the rise of new competition, changing regulations, and evolving customer expectations. Delighting customers demands a new strategy. And that strategy is gamification. Leading and progressive banks have introduced game elements to encourage users to adopt a desired behaviour.

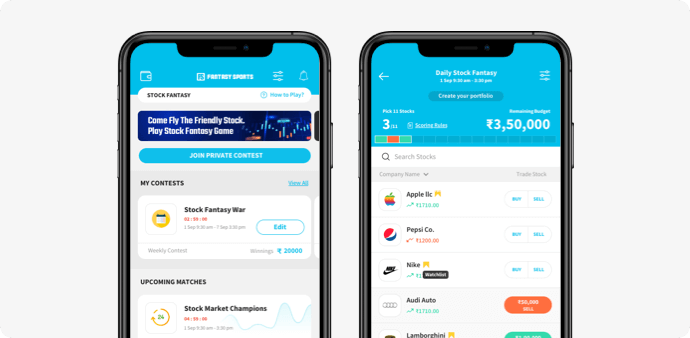

At VInfotech, we use a combination of game elements such as reward points, progress bars, quizzes, and virtual currency to help institutions engage their clients through stock fantasy gaming. Game formats include a combination of investing, learning, and predicting stock trade outcomes. These formats appeal to new investors who can invest without the risk of monetary loss and learn investing in an engaging way. The games also make investing fun for expert investors who can apply their knowledge and skills to make money. With our stock fantasy platform, players can participate in tournaments or daily fantasy contests, conduct private contests to play with their friends, participate in quizzes and earn points, and do much more. Get in touch with us at to know more about how you can turbocharge your engagement with VInfotechs’s solution.

References:

- 1. Gamification in retail banking - The Financial Brand

- 2. How better experiences will be the most powerful move for banks - StriveCloud

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.