Solving the “No Counter Bet” Problem in Prediction Markets

Learn how to fix the “no counterparty available” issue in prediction markets. Discover Vinfotech’s 4 proven liquidity solutions—FTP tournaments, price bands, early-bet bonuses, and safe micro-AMMs—to boost user confidence and engagement.

A practical playbook for iGaming teams—simple language, clear examples, workable fixes.

When users click Yes or No and see “no counterparty available,” it hurts confidence and kills engagement. This is the classic early-stage liquidity problem in prediction markets: too many people on one side, not enough on the other, so matching stalls and prices don’t move naturally.

Below is a clear, operator-friendly guide to fix this—what’s happening under the hood, and how Vinfotech solves it with four proven tools you can roll out right away.

Why does matching fail in the first place?

Prediction markets on events (e.g., “Team A to win?”) are usually binary: users buy Yes or No.

- The price of Yes is the market’s implied probability (e.g., 0.60 = 60% chance).

- The price of No is simply 1 − price(Yes).

Early or low-traffic markets often see one-sided participation. If most users want Yes, there aren’t enough No orders to match them. The result: unfilled orders, wide spreads, and stale prices—a poor user experience that deters the next bet.

Vinfotech’s four-part solution

We combine three low-risk liquidity boosters with an optional, tightly-controlled AMM (Automated Market Maker). Together they cover both new platforms and large, established audiences.

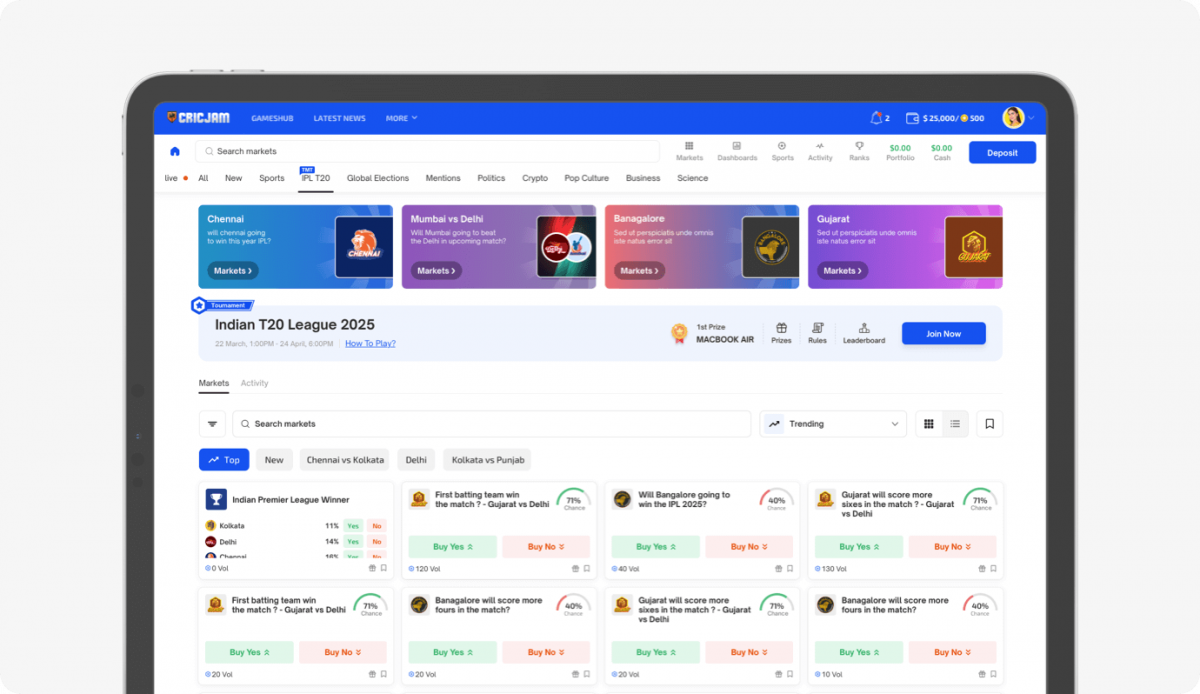

1) Free-to-Play Tournaments (no matching needed)

Run tournaments where users predict with virtual coins. In our Free-to-Play (FTP) mode, matching isn’t required—as more users pick a side, that side’s displayed “price” progresses so users can see movement and learn the mechanics without counter-order friction.

Why this helps

- Teaches price movement and confidence without real money.

- Creates early momentum so your first real-money markets don’t feel empty.

- Great for acquisition campaigns, onboarding, and sponsor tie-ins.

Example

Open a weekend “Matchday Predictor” across 10 games. Users enter with coins, climb leaderboards, and see prices respond to crowd behavior. On Monday, you review insights (popular sides, peak times) and use that to seed your paid markets.

2) Limited Price Range Movement (make matching easier)

For real-money or token play, we allow orders only within a band around the current reference price.

- If Yes = $0.60 and No = $0.40, set a ±$0.10 band so users can place orders only between $0.50 and $0.70 (and the complementary $0.30–$0.50 for No).

Why this helps

- Keeps prices near each other so counter orders meet faster.

- Prevents extreme outlier orders that fragment the book.

- With even modest traffic, this quickly produces natural matching.

Tip

Bands can be dynamic: start with ±$0.10, narrow to ±$0.05 as live volume grows, or widen during quiet hours.

3) Early-Bet Bonus (seed the first orders)

Give a small advantage to users who place a bet within, say, the first 2–3 hours of a market opening. This kick-starts activity so the book isn’t empty when the rest of your audience logs in.

Why this helps

- Solves the hardest part: first liquidity.

- Creates visible price action right away, which attracts later users to participate on either side.

- Works well with the price band to maintain a healthy spread.

Example

Market opens at 10:00. Early bettors until 12:00 get bonus coins (FTP) or a tiny fee rebate (paid). By mid-day, there’s a visible book and realistic prices.

4) AMM (Automated Market Maker)—optional, with safeguards

An AMM is an automated mechanism that always quotes both sides based on a formula. When humans aren’t present, it provides the counter order so trades can still clear.

In plain terms

- If many users keep buying Yes, the AMM raises the Yes price and offers No at the corresponding level.

- If flow flips toward No, the price adjusts the other way.

Why this is helpful

- Smooths trading during quiet periods, reduces friction, and keeps prices responsive.

But read this carefully: AMMs can carry inventory risk (ending up heavily exposed on the losing side when an event settles). That’s why we don’t recommend a big, always-on AMM at the start. Instead, we use a micro-AMM with strict guardrails

- Exposure caps per market and per side (hard limits).

- Dynamic spreads and fees that widen when one side gets crowded.

- Circuit breakers to pause the AMM on sharp moves or close to settlement.

- Time decay that reduces AMM depth as the event nears its result.

We’ll design this with you and switch it on only where needed—often a small subset of slower markets—after the first three tools are in place.

Deeper Dive: The Automated Market Maker (AMM) - Always a Match

Sometimes, even with the best strategies, you want a guarantee that a user can always place their bet, no matter what. That's where an Automated Market Maker (AMM) comes in.

What is an AMM?

Think of an AMM as a very smart, tireless robot that sits on your platform, always ready to take the opposite side of any bet. Its primary job isn't to make a profit for the prediction market platform on every single bet, but to ensure there's always liquidity. It uses a mathematical formula to determine prices and manage the platform's overall exposure.

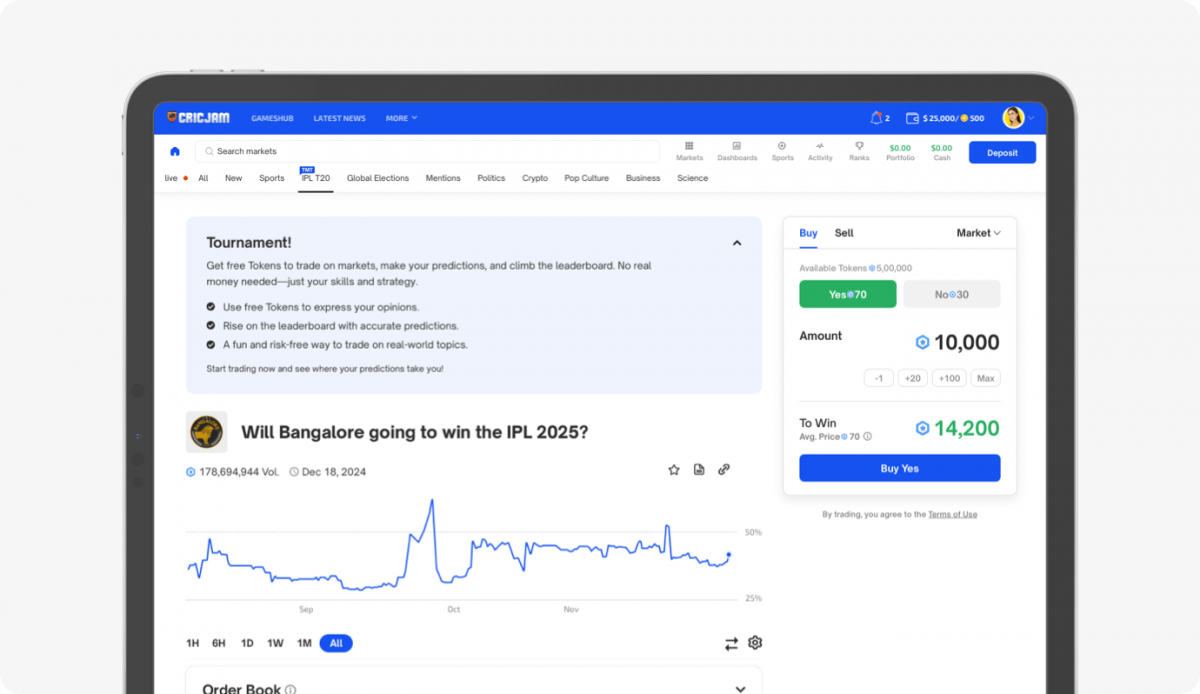

How it Works: An Example

Let's say the question is: "Will [Team A] win the championship?"

- Initial State: The market is quiet. "Yes" is at $0.50, "No" is at $0.50.

- User 1 Bets "Yes": A user wants to bet $100 on "Yes" at $0.50.

- Without AMM: If no one is selling "Yes" at $0.50 (or buying "No" at $0.50), the user might not be able to place their bet. Frustrating!

- With AMM: The AMM instantly sells $100 worth of "Yes" shares to User 1. The platform now effectively holds the "No" position for this $100.

Price Adjustment: Immediately after User 1's bet, the AMM's algorithm kicks in. It now slightly increases the price of "Yes" (e.g., to $0.52) and decreases the price of "No" (e.g., to $0.48). This makes "No" look more attractive to the next user, encouraging them to buy "No" and help balance the platform's books.

User 2 Bets "No": Later, another user sees the new "No" price of $0.48 and bets $100 on "No." The AMM takes their bet, reducing the platform's exposure to "No."

The AMM continuously adjusts prices based on buying and selling activity, always trying to encourage balance and ensuring there's always a price for users to trade at.

Who Should Consider an AMM?

Platforms Demanding Ultimate User Experience: If your absolute top priority is that a user should never, ever be blocked from placing a bet due to liquidity, an AMM is the answer.

Platforms with Managed Risk Appetites: While an AMM introduces financial risk (the platform can lose money if it takes the wrong side of too many bets), this risk can be heavily managed through features like:

- Maximum Exposure Caps: Setting a limit on how much net money the AMM can risk on any single market (e.g., "AMM will not take on more than $50,000 net exposure").

- Dynamic Fee Structures: Adjusting fees to offset potential losses.

- Leveraging High Volume: For platforms with millions of users, the natural ebb and flow of a large market often balances the AMM's exposure without hitting caps. The AMM acts more like a "liquidity cushion" than a constant counter-party.

Operators Seeking Differentiation: Offering guaranteed liquidity can be a powerful selling point compared to competitors.

If you’re new (early audience or fresh launch)

Start with the low-risk trio

- FTP tournaments to attract users, teach mechanics, and build habit.

- Price bands to keep orders close and match quickly.

- Early-bet bonus to seed the book every time a market opens.

Add a micro-AMM pilot only on 2–3 quiet markets if you still see gaps. Keep exposure tiny. Review weekly. Expand only if fees + engagement lift justify it.

If you already have a large user base

With, say, 2–3 million users, you might not need AMM at all.

- Launch FTP for broad reach and education—it’s fantastic for acquisition and sponsor inventory.

- Enable price bands in paid markets; with your traffic, organic matching should form quickly.

- Use early-bet bonuses to ensure every market starts with momentum.

- Consider a micro-AMM only for niche, low-traffic events, with tight caps and auto-pauses.

Example

A football operator with 2.5M users runs weekend match predictors (FTP) plus 8–12 live paid markets with ±$0.10 bands. Early-bet bonus creates sharp opening activity; most markets match cleanly without any AMM. Only two long-tail markets get a capped micro-AMM during off-hours.

AMM: a simple primer (for decision-makers)

What it is: An automated counterparty that quotes prices using a formula.

Common flavors

- CPMM (constant product): simple, responsive; price moves faster with imbalances.

- LMSR (scoring-rule based): smooth updates with a tunable parameter that bounds worst-case loss.

- Hybrids: add spreads/fees that widen as risk rises.

The risk: Accumulating too much of the side that ultimately loses.

How we manage it: small sizes, strict caps, dynamic spreads/fees, circuit breakers, and limited time windows.

Bottom line: Treat AMM as a scalpel, not a hammer. Use it sparingly, with controls.

What to measure (so you know it’s working)

- Fill rate: % of orders that get matched without friction.

- Average spread: Is the market tight enough for a good user experience?

- Depth at best price: Real size users can hit immediately.

- Time-to-first-bet: How fast does a new market get its first trades?

- FTP → Paid conversion: Are tournaments feeding your monetized markets?

- AMM P&L (if used): Net of fees, by market, reviewed weekly.

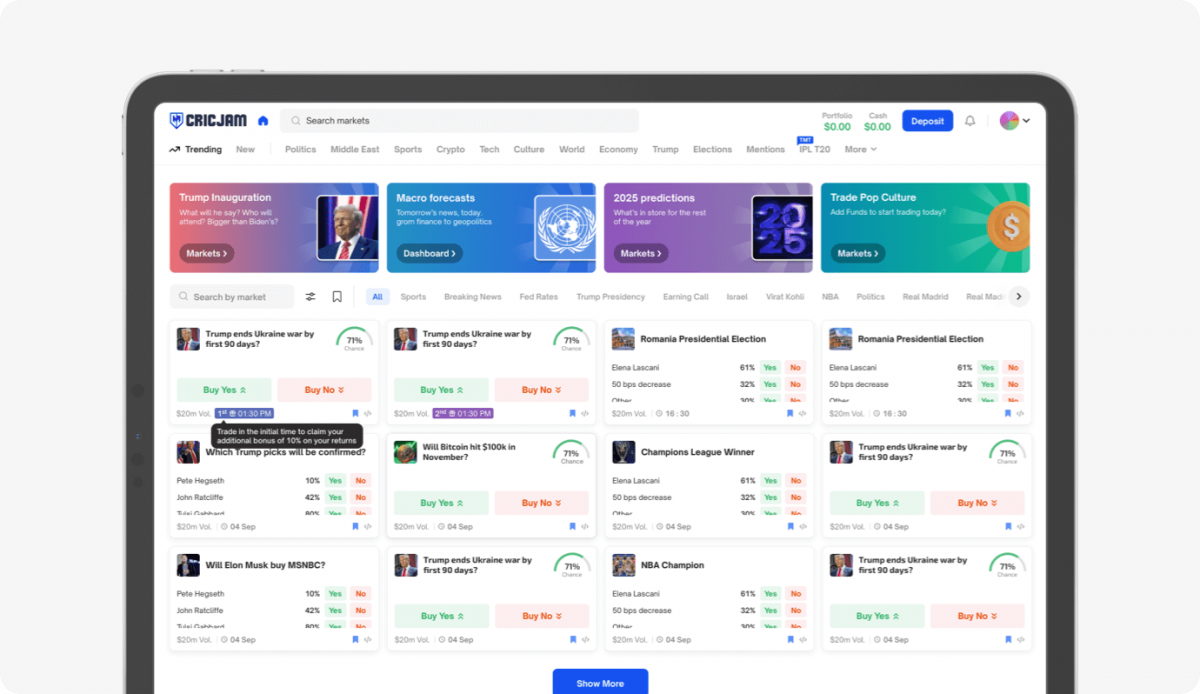

Where Vinfotech fits in

We can integrate prediction market software into your current iGaming product or launch it standalone. Everything is customizable—UI/UX, bands, bonus windows, tournament formats, fee ladders, and any AMM guardrails. We’ll help you pick the right mix for your audience size, compliance posture, and business goals (acquisition, engagement, or new revenue).

Have questions?

Send us a couple of your typical markets (sport, league, timing), your primary goal (acquisition, engagement, or revenue), and your target regions. We’ll reply with a crisp starter configuration you can ship fast.

Don't let liquidity fears hold you back. At Vinfotech, we combine robust features with smart strategies to ensure your prediction market is vibrant, engaging, and always ready for the next big bet. Ready to explore how we can tailor these solutions for your platform? Contact us today!

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.