Beyond Betting - The New Playbook for Fan Engagement and Monetization in Indian Sports

Explore Indian gaming bill sports league strategies, compliant fan engagement solutions, and revenue opportunities post-ban with social gaming and first-party data.

Executive Summary

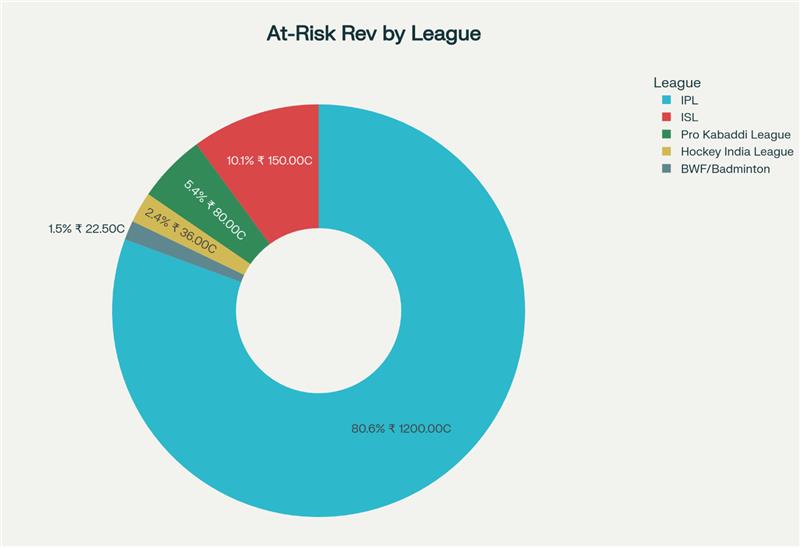

The passage of the Promotion and Regulation of Online Gaming Bill, 2025 represents a watershed moment for Indian sports. What initially appears as a crisis—with Dream11's immediate exit from BCCI sponsorship and potential losses of over ₹1,000 crore in annual revenue—is actually a catalyst for leagues to build a more resilient and profitable future.

The ban on real-money gaming forces a fundamental shift from transactional relationships (sponsorship for visibility) to relational ones (engaging fans for loyalty and data). The solution lies in social gaming for sports leagues India—compliant, non-monetary fan engagement tools that not only satisfy regulatory requirements but unlock three transformative benefits: owning fan data after gaming bill, generating invaluable first-party data strategies sports India, and future-proofing the business against regulatory volatility.

Indian cricket, football (ISL), and kabaddi leagues now have an unprecedented opportunity to build direct relationships with their massive fanbases, moving beyond traditional sponsorship models to create sustainable, fan-centric revenue streams.

The Crisis & The Catalyst

The Promotion and Regulation of Online Gaming Bill, 2025, passed with unprecedented speed between August 20-22, 2025, imposes a complete ban on online games involving monetary stakes, regardless of whether they're skill-based or chance-based. The legislation's impact on Indian sports has been immediate and severe.

Dream11, valued at $8 billion, terminated its ₹358 crore three-year sponsorship deal with BCCI within days of the bill's passage. My11Circle's ₹625 crore five-year IPL partnership faces similar uncertainty. The Pro Kabaddi League, which saw 60% growth in brand sponsorships reaching over ₹100 crore per franchise, and the Indian Super League, with its expanding digital ecosystem, must now navigate this new landscape.

The financial shock is undeniable—BCCI faces immediate revenue gaps, and the government acknowledges potential GST collection losses of ₹15,000-20,000 crore annually. However, this disruption exposes a fundamental weakness in Indian sports' commercial model: over-dependence on a single, legally vulnerable revenue stream.

The Real Opportunity: This crisis forces leagues to evolve from passive content providers (selling eyeballs to sponsors) to active fan engagement platforms. The ban doesn't eliminate fan appetite for interaction—it redirects it toward compliant fan engagement solutions India that can generate more sustainable value.

The New Playbook: Embracing Social Gaming

Social gaming represents the compliant alternative explicitly encouraged by the new legislation. Unlike real-money gaming, these are non-monetary, points-based interactive experiences that enhance fan engagement without legal risk.

This transition directly addresses the demand for alternatives to fantasy sports sponsorship and digital monetization sports leagues post-ban.

Core Social Gaming Categories for Indian Sports

Predictor Games: Real-time engagement during live matches

- Cricket: Predict next over's runs, boundary count, player performance milestones

- Football: Guess next goal scorer, half-time scores, cards awarded

- Kabaddi: Predict successful raids, tackle counts, match turnarounds

Fantasy Games: Non-monetary, points-based team building

- Season-long leagues with leaderboards and recognition

- Weekly challenges tied to specific matches or tournaments

- Cross-sport fantasy combining IPL, ISL, and PKL performers

Knowledge & Trivia Games: Content-rich interactions testing fan expertise

- Historical moments, player statistics, rule interpretations

- Live quiz shows during match intervals

- Regional language content for deeper market penetration

These games, when hosted on league-owned digital platforms, eliminate dependence on third-party aggregators and place leagues in direct control of fan relationships.

Three Pillars of Strategic Benefit

Pillar 1: Grow Fan Engagement & Retention

How to engage fans after real-money gaming ban is now the central question for every league. Social gaming transforms passive viewership into active participation. Research shows that 47% of engaged fans in India actively use digital platforms for sports content consumption, surpassing the global average of 33%. Interactive games capitalize on this digital appetite by

- Extending Attention Spans: Fans remain engaged from first ball to last, increasing broadcast dwell time and digital platform usage

- Creating Year-Round Connection: Off-season content through draft predictions, historical challenges, and player analysis maintains engagement beyond match days

- Building Community: Leaderboards, group competitions, and social features foster fan-to-fan connections that strengthen league loyalty

The IPL's success model demonstrates how entertainment-focused engagement (music, spectacle, interactive elements) enhances rather than detracts from sports consumption, with over 505 million TV viewers and 449 million digital viewers in 2023.

Pillar 2: Generate First-Party Data

First-party data represents the most valuable asset in modern sports marketing. European football clubs report first-party data penetration rates of less than 5% with younger demographics, while Indian leagues have similar challenges despite massive social media followings.

Social gaming solves this through

- Registration Requirements: Game participation necessitates account creation with name, email, location, and preferences

- Behavioral Tracking: In-game choices reveal detailed fan preferences, loyalty patterns, and engagement depth

- Segmentation Opportunities: Data enables hyper-personalized marketing for ticket sales, merchandise, and experiences

The Commercial Value: This data enables leagues to offer data-driven sponsorship packages to brands, providing access to highly-engaged, segmented audiences rather than generic demographic estimates.

Pillar 3: Unlock New, Compliant Sponsorship Assets

Social games themselves become highly valuable, sponsorable assets that generate revenue through:

Branded Game Experiences

- "Tata Predict the Score" during IPL matches

- "Hero MotoCorp Player Performance Challenge" in ISL

- "Vivo Pro Kabaddi Quiz of the Week"

Data-Driven Brand Partnerships: Leagues can offer sponsors first-party audience insights for targeted campaigns, moving beyond traditional logo-on-jersey deals to sophisticated audience activation.

Enhanced Sponsorship ROI: Brands gain access to engaged, opted-in audiences with detailed preference data, justifying premium pricing and longer-term commitments.

A Practical Guide for Leagues

Acknowledging that most Indian sports leagues lack in-house technical expertise and face budget constraints, we recommend a phased, practical approach:

Phase 1: Start Simple (30-60 days)

- MVP Launch: Deploy a single predictor game on existing league websites/apps

- Leverage Current Assets: Use on-air promotions during broadcasts, social media campaigns, and in-stadium announcements to drive participation

- Pilot Revenue: Secure one brand partner to sponsor the initial game experience

Phase 2: Leverage Existing Assets (3-6 months)

- Cross-Platform Integration: Expand games across all league touchpoints (mobile apps, websites, social media)

- Content Marketing: Use established broadcast partnerships and media relationships to promote engagement

- Fan Education: Communicate the value proposition clearly—free participation, exclusive content, community recognition

Phase 3: Partner Strategically (6-12 months)

Rather than building internal teams, leagues should partner with specialist B2B technology providers who offer

- Compliant gaming platform development and maintenance

- Data analytics and audience segmentation tools

- Revenue optimization strategies and sponsor integration capabilities

This approach allows leagues to focus on their core competency (sports content and fan relationships) while accessing expert technology and scaling efficiently.

The Competitive Advantage: Why Leagues Will Win

Indian sports leagues possess unique advantages that fantasy gaming platforms never had

Content Ownership: Leagues control the underlying sports content that drives fan passion

Brand Trust: Established relationships with fans built over years of authentic sports experiences

Distribution Power: Direct access to broadcast audiences, stadium attendees, and official social media channels

Regulatory Clarity: League-operated social gaming faces minimal regulatory risk compared to third-party money gaming platforms

The IPL ecosystem demonstrates this potential—generating over $15 million per game through integrated entertainment, community building, and commercial partnerships, all while maintaining regulatory compliance and fan satisfaction.

Conclusion

The Promotion and Regulation of Online Gaming Bill, 2025 is not the end of monetized fan engagement in Indian sports—it's the beginning of a more sustainable, profitable, and legally secure era. By embracing social gaming, leagues can transform from passive content providers dependent on external sponsors into active fan engagement platforms that own their audience relationships.

The leagues that act quickly will establish first-mover advantages in capturing fan data, building engagement habits, and attracting forward-thinking sponsors who recognize the value of direct audience access. Those who delay risk losing their most passionate fans to other entertainment alternatives that better understand digital engagement.

The path forward is clear: Move beyond betting to build lasting fan relationships that generate sustainable revenue while remaining fully compliant with India's regulatory framework. The future belongs to leagues bold enough to take control of their fan destiny.

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.