The Rise of Free-to-Play Fantasy Sports: Capitalizing on India's RMG Ban

The shift from RMG to free-to-play fantasy sports is reshaping India’s gaming scene, driving innovation, user growth, and sustainable engagement.

The Indian fantasy sports landscape has undergone a dramatic transformation following the Promotion and Regulation of Online Gaming Act, 2025, which banned all real-money gaming (RMG) platforms effective August 2025. This unprecedented regulatory shift has created a massive gap in the market, forcing major platforms like Dream11, MPL, and Games24x7 to shut down their money-based operations. While this disruption initially seemed catastrophic for the industry, it has actually opened up an extraordinary opportunity for innovative operators to fill the void with free-to-play, coin-based fantasy sports platforms.

The Market Vacuum Created by RMG Ban

The scale of disruption cannot be overstated. India's fantasy sports market, valued at approximately $1-1.2 billion in 2024, was projected to reach $2-2.6 billion by 2030. The ban effectively eliminated the primary revenue stream for over 400 companies, potentially impacting more than 200,000 jobs and ₹20,000 crore in annual tax contributions. Dream11 alone reported ₹9,600 crore in revenue in FY24, with over 95% coming from paid fantasy contests.

Major platforms have been forced to pivot rapidly. Dream11 suspended all "Pay to Play" contests and shifted entirely to free-to-play formats. Similarly, MPL, Zupee, Games24x7's My11Circle, and Gameskraft's RummyCulture have all discontinued their real-money operations. This mass exodus has left millions of fantasy sports enthusiasts without their preferred gaming platforms, creating an unprecedented opportunity for new market entrants.

The Free-to-Play Alternative: A Proven Model

The transition to free-to-play isn't just a regulatory necessity—it's a viable business model with proven success. The Fantasy Premier League, which boasts over 11 million global players, demonstrates that engagement doesn't require cash prizes. Players compete for bragging rights, league rankings, and social recognition, funded through advertising, sponsorships, and partnerships.

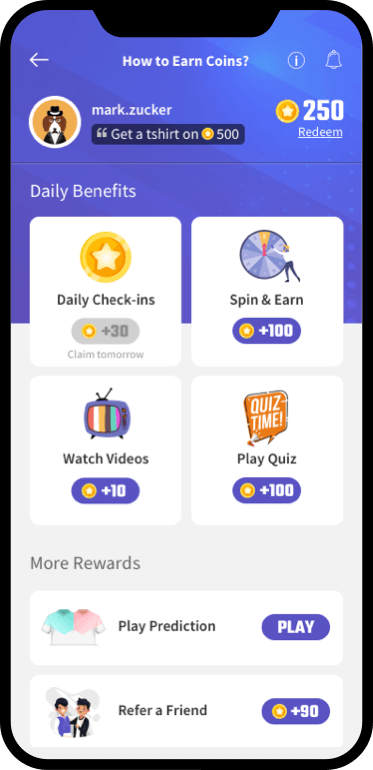

Modern free-to-play platforms are implementing innovative coin-based ecosystems that maintain user engagement while generating sustainable revenue. Users can earn coins through various activities:

- Daily check-ins to encourage regular platform visits

- Referral programs to drive organic user acquisition

- Contest participation to maintain competitive engagement

- Social interactions and achievements to build community

Additionally, users can purchase coins directly, creating a microtransaction revenue stream that doesn't violate RMG regulations since coins cannot be converted back to cash.

Revenue Model Innovation: Beyond Traditional DFS

The new coin-based model opens up multiple revenue streams that traditional RMG platforms couldn't fully exploit

Primary Revenue Streams

1. Coin Purchases: Users buy coins to enter premium contests or unlock special features, similar to mobile gaming freemium models that generated $109.8 billion globally in 2024.

2. Advertising Revenue: With high user engagement and detailed demographic data, platforms can command premium advertising rates. The fantasy sports audience is particularly valuable to sports brands, consumer brands and lifestyle brands.

3. Merchandise and Prize Fulfillment: Instead of cash payouts, winners receive merchandise, gadgets, vouchers, and experiential rewards. This creates partnership opportunities with retailers and brands while maintaining profit margins on physical goods.

Secondary Revenue Opportunities

4. Data Monetization: Fantasy platforms generate valuable insights into user preferences, sports engagement patterns, and consumer behavior that can be monetized through partnerships with sports leagues, broadcasters, and market research firms.

5. Subscription Services: Premium tiers offering advanced analytics, exclusive content, expert tips, and ad-free experiences can generate recurring revenue from serious players.

6. Brand Partnerships: Collaboration with sports leagues, teams, and influencers can create sponsored tournaments, branded contests, and co-marketing opportunities.

Market Opportunity: Serving Underserved Demand

The current market disruption has created an extraordinary opportunity. Before the ban, India had over 200 million fantasy sports users, with cricket contributing 85-90% of platform revenues. The Indian Premier League (IPL) alone served as a "super-cycle" for user acquisition and monetization.

These users haven't disappeared—they're simply underserved. Recent market research indicates that the Indian fantasy sports market could still grow from $751 million in 2023 to over $3.4 billion by 2031, even in a post-RMG environment, driven by

- 568 million gaming users making India the world's largest gaming market

- 95.15% of villages covered with 3G/4G networks

- A predominantly young demographic (25-40 years) that's digitally native

- Growing interest in non-cricket sports like Kabaddi (crossing 200 million viewers) and Football

Technology Solution: White-Label Platforms

The speed to market is crucial in capturing this opportunity. White-label fantasy sports platforms offer the fastest route to market, allowing operators to launch fully functional platforms within weeks rather than months.

Vinfotech's white-label solution addresses this exact opportunity by providing

- Rapid deployment capability (2-4 weeks to market)

- Full customization options for branding and user experience

- Coin-based economic system compliant with current regulations

- Multi-sport support (Cricket, Football, Kabaddi, Basketball, and more)

- Scalable architecture to handle millions of users

- Integrated payment systems for coin purchases

- Comprehensive admin panels for contest management and user analytics

The Competitive Advantage Window

The current market disruption creates a temporary competitive advantage window. Established players are dealing with regulatory compliance, workforce reductions, and business model pivots. New entrants with purpose-built free-to-play platforms can capture market share while incumbents reorganize.

Key success factors include:

- 1. Speed to Market: Launching while user demand is high and competition is limited

- 2. User Experience: Creating engaging gameplay that rivals traditional RMG platforms

- 3. Community Building: Fostering social competition and achievement systems

- 4. Content Strategy: Providing valuable sports content, analysis, and engagement beyond just contests

- 5. Mobile-First Design: Optimizing for smartphone users who comprise the majority of the market

Regulatory Compliance and Future-Proofing

The new regulatory environment, while disruptive, provides clarity for compliant operators. The Online Gaming Act, 2025 explicitly supports and promotes e-sports, educational games, and social gaming. Free-to-play, coin-based platforms fall clearly within the legal framework, providing regulatory certainty that RMG platforms never enjoyed. This compliance advantage extends beyond India. Similar regulatory trends are emerging globally, with governments increasingly scrutinizing real-money gaming. Platforms built on free-to-play models with non-cash rewards are better positioned for international expansion and long-term sustainability.

Implementation Strategy

For operators looking to capitalize on this opportunity, the implementation strategy should focus on:

Phase 1: Rapid Launch (Weeks 1-4)

- Deploy white-label platform with core fantasy sports functionality

- Implement coin-based economy with purchase and earning mechanisms

- Launch with cricket focus during active tournament seasons

Phase 2: User Acquisition (Months 1-3)

- Aggressive marketing campaigns targeting displaced RMG users

- Referral incentive programs to drive organic growth

- Partnerships with sports content creators and influencers

Phase 3: Monetization (Months 2-6)

- Introduce premium features and subscription tiers

- Launch branded merchandise and prize fulfillment programs

- Develop advertising partnerships with sports and lifestyle brands

Phase 4: Expansion (Months 4-12)

- Add additional sports (Football, Kabaddi, Basketball)

- Introduce social features and community building tools

- Consider international market expansion

Conclusion: The New Era of Fantasy Sports

The RMG ban in India has fundamentally reshaped the fantasy sports landscape, eliminating billions in revenue from traditional platforms but creating an unprecedented opportunity for innovative operators. The millions of fantasy sports enthusiasts haven't disappeared—they're simply waiting for engaging, legal alternatives.

Free-to-play, coin-based platforms represent the future of fantasy sports in India and potentially globally. By focusing on community, engagement, and diverse revenue streams beyond entry fees, these platforms can build sustainable businesses while serving the massive underserved demand created by regulatory changes.

The opportunity window is limited. First movers who can rapidly deploy engaging, compliant platforms will capture the largest share of displaced users and establish market leadership in the new fantasy sports era. Vinfotech's white-label solution provides the technology foundation to seize this moment and build the next generation of fantasy sports platforms.

The question isn't whether this opportunity exists—it's whether operators will move quickly enough to capitalize on it before the window closes and new market leaders emerge.

Also read: Beyond Betting - The New Playbook for Fan Engagement and Monetization in Indian Sports

About Vinfotech

Vinfotech creates world’s best fantasy sports-based entertainment, marketing and rewards platforms for fantasy sports startups, sports leagues, casinos and media companies. We promise initial set of real engaged users to put turbo in your fantasy platform growth. Our award winning software vFantasy™ allows us to build stellar rewards platform faster and better. Our customers include Zee Digital, Picklive and Arabian Gulf League.